Insurance Industry Valuation Multiples

6000-6799 Finance Insurance and Real Estate Report Date. 2018 Insurance MA outlook The deal landscape continues to evolve.

Credit Memo Tips For Credit Committee Presentations Financetrainingcourse Com Finance Binder Free Finance Organization Printables Money Mom

Credit Memo Tips For Credit Committee Presentations Financetrainingcourse Com Finance Binder Free Finance Organization Printables Money Mom

Only four of the 53 announced property and casualty PC deals and five of the 31 announced life and health LH deals reported price-to-book value PBV multiples.

Insurance industry valuation multiples. Industry Specific Multiples Over the years valuation experts have distinguished patterns in the selling price of businesses and financial ration of relevant groups. Valuation Multiples by Industry httpswwwevaltech SIC Sector. Over the past 10 years our advisors have been a part of over 150 insurance transactions representing over 250M in transaction values.

This multiple indicates the. Those factors are the multiple of. A ratio above 100 means the.

Industry specific multiples are the techniques that demonstrate what business is worth. Our clients include Retail Agents MGAs and Program Administrators. Insurance stocks underperformed the broader markets as the market capitalization of publicly traded property and casualty PC and life and health LH companies decreased by 137 and 292 respectively between December 31 2019 and September 30 2020.

The first thing to understand is that there are typically three multiples that factor into the value of an insurance agency. In markets outside the US most Life Insurance companies trade around a multiple of or discount to embedded value. 1 net revenues 2 discretionary earnings.

292015 Multiples of EBITDA earnings before interest taxes depreciation and amortization has been used for various business valuations investment decisions and. This growth rate is on par with the past five years annualized growth rate of 31. 12182017 In fact looking at valuations as an implied multiple of VNB is also crucial in understanding fair valuations.

The aggregated valuation figures are a product of very few data points and therefore may not be reliable. 6252019 A number of valuation metrics are more specific to the insurance industry. Market capitalization and market multiples.

United States of America USA Industry Valuation Multiples The table below provides a summary of median industry enterprise value EV valuation multiples as at the Report Date. These patterns industry specific multiples determine the current value of a company. 30 October 2020 Country.

The Combined Ratio measures incurred losses and expenses as a percentage of earned premiums. For some sectors an EBITDA multiple is not the most commonly utilised metric. In 2018 the industry recorded 1653 billion in revenue and a 29 growth rate.

For example a business with an EBITDA of 10 million with comparable EBITDA multiples of between 6 and 8 times would likely be valued between 60 million and 80 million. This is almost like a book value for the insurance company as it adds the discounted profits expected to emerge from the current book of policy holders to the NAV for the shareholder funds. Although it may seem counterintuitive the best time to sell a business is during a healthy economy.

INS Capital Group LLC is an MA and Capital Solutions advisory firm specializing in the insurance industry. Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000 sold private companies listed in the DealStats database. 132019 Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple.

198 rows Our Valuation Multiples by Industry sector reports are based on industry valuation. 2122019 Insurance brokers make up one of the largest industries in the US.

Munis Outperform During Rising Rate Cycles Bond Insurance Investment Advice Tax Time

Munis Outperform During Rising Rate Cycles Bond Insurance Investment Advice Tax Time

Ebitda Multiples Of Global Insurtech By Subsector 2020 Statista

Ebitda Multiples Of Global Insurtech By Subsector 2020 Statista

Valuation Of Banks And Insurers In Times Of Covid 19

Valuation Of Banks And Insurers In Times Of Covid 19

Delta Hedging Options Using Monte Carlo Simulations In Excel Monte Carlo Delta Meaning Delta

Delta Hedging Options Using Monte Carlo Simulations In Excel Monte Carlo Delta Meaning Delta

Top 5 Life Insurance Mistakes People Make Life Insurance Uk Life Insurance Insurance

Top 5 Life Insurance Mistakes People Make Life Insurance Uk Life Insurance Insurance

Clayton Christensen 3 Types Of Business Models Marketing Analysis Business Design Business Marketing

Clayton Christensen 3 Types Of Business Models Marketing Analysis Business Design Business Marketing

Pre Money Vs Post Money Valuation Home Insurance Quotes How To Raise Money Home Insurance

Pre Money Vs Post Money Valuation Home Insurance Quotes How To Raise Money Home Insurance

Global M A Industries With The Highest Valuation Multiples 2018 Statista

Global M A Industries With The Highest Valuation Multiples 2018 Statista

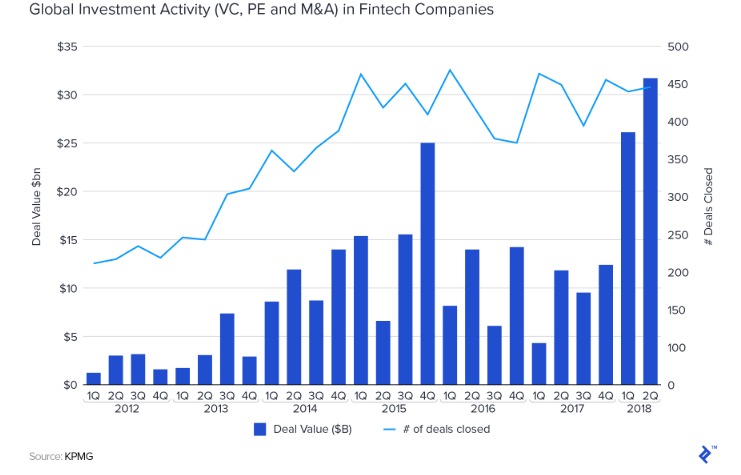

How To Value A Fintech Startup Fintech Is A Popular Contemporary By Nirvikar Jain The Startup Medium

How To Value A Fintech Startup Fintech Is A Popular Contemporary By Nirvikar Jain The Startup Medium

Median Saas Ttm Revenue Valuation Multiples Opexengine

Median Saas Ttm Revenue Valuation Multiples Opexengine

Etps Aum Lead Over Hedge Funds Is Now At 1 70 Trillion Etfgi Reports Assets Invested In The Global Etf Industry E Hedge Fund Investing Fund Investment Advice

Etps Aum Lead Over Hedge Funds Is Now At 1 70 Trillion Etfgi Reports Assets Invested In The Global Etf Industry E Hedge Fund Investing Fund Investment Advice

Argus Valuation Dcf Reporting With Microsoft Excel Microsoft Excel Excel Microsoft

Argus Valuation Dcf Reporting With Microsoft Excel Microsoft Excel Excel Microsoft

Kri Loss Events And Estimating Operational Risk Capital Risk Management Case Study Risk

Kri Loss Events And Estimating Operational Risk Capital Risk Management Case Study Risk

Most Relevant Multiples Valuation Multiples By Industry Download Table

Most Relevant Multiples Valuation Multiples By Industry Download Table

Poptopnews Cloud Mining Genesis Clouds

Poptopnews Cloud Mining Genesis Clouds

Global Ev Ebitda Acquisition Multiple By Sector Statista

Global Ev Ebitda Acquisition Multiple By Sector Statista

Interest Rate Swap Value At Risk Calculation In Excel Interest Rate Swap Interest Rates Currency

Interest Rate Swap Value At Risk Calculation In Excel Interest Rate Swap Interest Rates Currency

The World Economic Forum On The Future Of Jobs Techcrunch World Economic Forum Sharing Economy Job

The World Economic Forum On The Future Of Jobs Techcrunch World Economic Forum Sharing Economy Job

Post a Comment for "Insurance Industry Valuation Multiples"