Insurance Premium Superannuation

If you havent heard from your super fund or youre unclear on whats happening to your insurance get in touch with them. The premium can be a larger amount due to increases to sum insured which have the applicable level premium rate applied for your current age when you accept the inflation rate increase or apply for a general increase in level of cover.

Insurers assess and price a range of risk factors to work out how much they would need to pay out if you made a claim against your insurance policy.

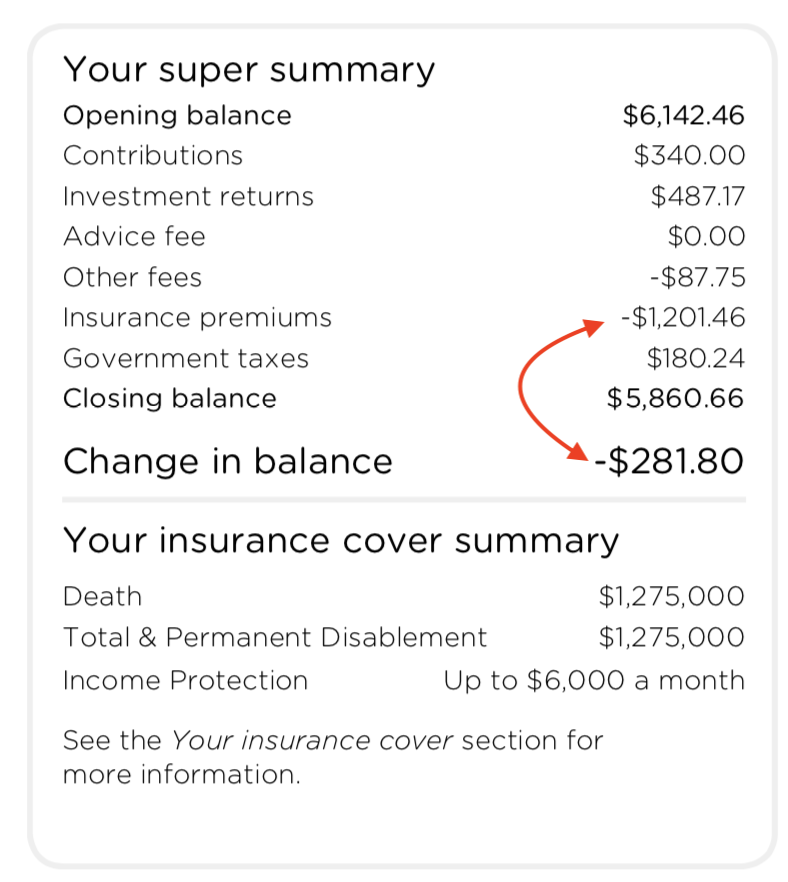

Insurance premium superannuation. One of the benefits of being a Statewide Super member is premiums are deducted directly from your account. Compensation for loss of earnings or interest. Easy to pay insurance premiums are automatically deducted from your super balance.

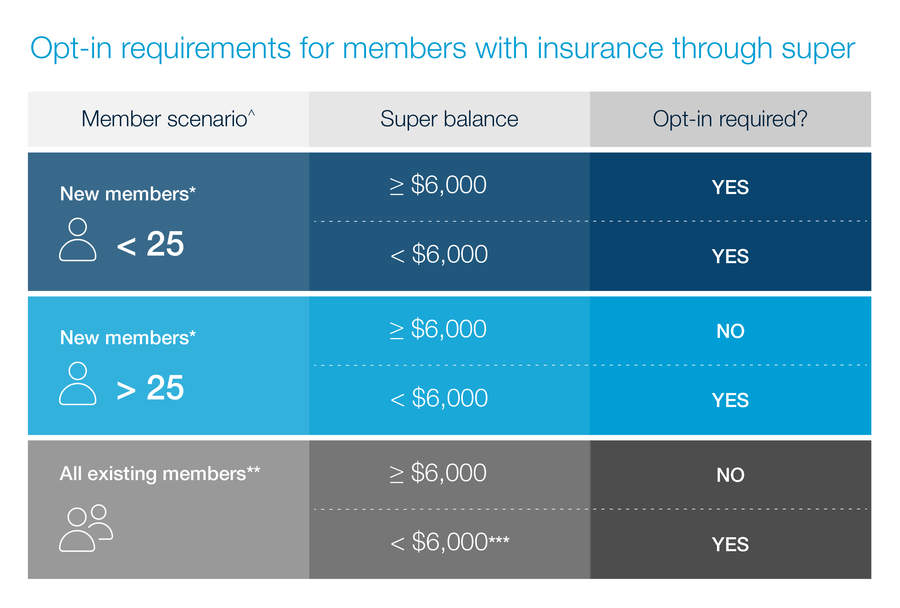

1132021 Income protection insurance is tax-deductible outside super provided the member has no cover within their fund so the decision to hold it in or out of super will depend on your marginal tax rate. Life insurance premiums inside superannuation are on the rise due to legislation making insurance opt-in for young members inactive accounts and low balance accounts. Insurance in your superannuation.

Premiums for life TPD and income protection inside superannuation are generally tax deductible to the superannuation fund that owns the insurance policy. Where data and records are incomplete or inadequate APRA expects these. The premiums are paid by the fund so a fund members personal cash flow isnt affected.

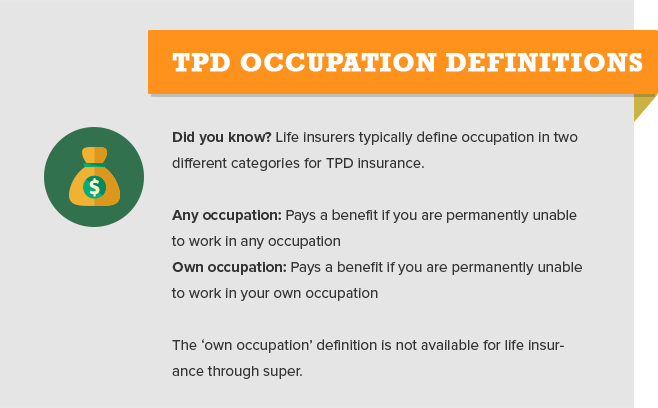

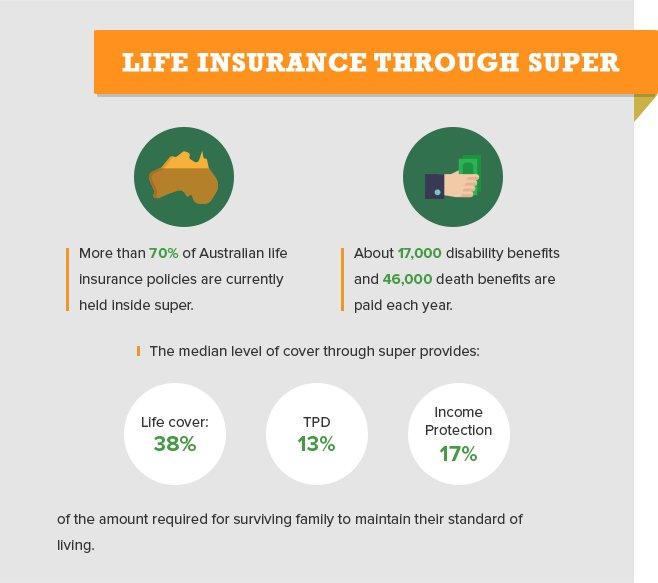

The table in s295-465 1 of the Tax Act outlines the proportions of insurance premiums for different types of policies that can be claimed. Most superannuation funds offer insurance for their members. Insurance through super With insurance through your super you can protect your income and prepare for the future.

The insurer will charge the trustee premiums for this insurance. Cheaper premiums Premiums are often cheaper as the super fund buys insurance policies in bulk. Help safeguard your finances against the unexpected.

Insurance Premium Calculator Once youve worked out your insurance needs using our Insurance Needs Calculator use the Insurance Premium Calculator to find out how much youll pay each month for your required level of cover. Therefore the tax deduction for the insurance premiums reduces the tax payable on this income by 15. Fewer health checks Most super funds will accept you for.

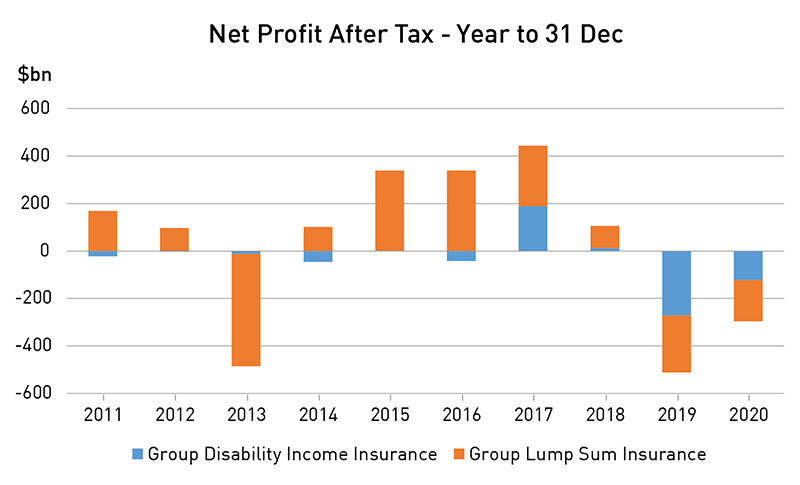

1182021 Superannuation funds can typically negotiate group discounts on the life insurance premiums charged to their members due to the size of their membership base. Risk factors can include your smoking status height weight family. Most super funds are raising their insurance premiums for the new financial year in response to the new Protecting Your Superannuation legislation.

This does not always make it cheaper than equivalent insurance cover you could negotiate yourself but it means that the insurance premiums may well be very competitively priced. Calculate your insurance premiums. These changes effectively reduce the number of members with insurance cover and premium revenue potentially making premiums more expensive for everyone else as cross subsidies are removed.

CHANGES TO THE INSURANCE POLICY TERMS AND CONDITIONS Terminal Illness life expectancy period changed to align with superannuation terminal medical condition. Prudential Standard SPS 250 Insurance in Superannuation SPS 250 requires RSE licensees to maintain sufficient records that can form the basis for insurers to assess and price insured benefits. Keep in mind that income protection insurance premiums are generally tax deductible in your individual name also.

A superannuation fund is generally subject to a 15 tax rate on its income. Your insurance needs Types of insurance cover Start-up bonus cover Make an insurance claim Insurance in Super Voluntary Code of Practice Adding to your superannuation. Your fund should have sent you a letter or email outlining the changes.

1202021 Life insurance premiums inside superannuation are on the rise due to legislation making insurance opt-in for young members inactive accounts and low balance accounts. How to add to your superannuation and retire better. 1172021 The premium for insurance cover is determined by the level of risk or the chance of something harmful or unexpected happening for the insured person.

The portion of an insurance premium that a superannuation fund can claim will depend on the type of policy and what cover that policy provides. 1152018 Yes income protection insurance premiums are a tax deductible expense to the trustee of the superannuation fund who should then apply the tax deductioncredit towards your member balance. Most insurance policies allow the insurer to change premiums.

This insurance is provided by an insurance company. The revised insurance premium rate tables in this flyer apply from 1 July 2016 and are guaranteed to remain unchanged until 30 June 2018. AustralianSuper provides most members with basic insurance cover with their super account.

This cover provides a basic level of. Refund of insurance premiums An amount of a death or disability insurance premium that is refunded to a super fund where the super fund was allowed a deduction in respect of the original premium will be assessable income of the fund for the year in which the refund is received. Super funds with the lowest fees for income protection insurance.

Can You Pay For Life Insurance Through Your Superannuation

Can You Pay For Life Insurance Through Your Superannuation

Super Fees Fall As Funds Merge And Members Drop Multiple Accounts

Super Fees Fall As Funds Merge And Members Drop Multiple Accounts

Personal Insurance Cover Florisson Financial

The Benefits Of Insurance In Super Bussq Superannuation

The Benefits Of Insurance In Super Bussq Superannuation

Understanding Your Super Fund S Fees And Costs Video Rask Education

Understanding Your Super Fund S Fees And Costs Video Rask Education

Changes To Insurance Within Super For Low Balance Accounts And New Super Members Bt

Changes To Insurance Within Super For Low Balance Accounts And New Super Members Bt

Factsheet Insurance Premium Increases In Superannuation Australian Financial Complaints Authority Afca

Factsheet Insurance Premium Increases In Superannuation Australian Financial Complaints Authority Afca

Life Insurance And Tpd Insurance What They Cover How Much They Cost

Life Insurance And Tpd Insurance What They Cover How Much They Cost

Super Fees Fall As Funds Merge And Members Drop Multiple Accounts

Super Fees Fall As Funds Merge And Members Drop Multiple Accounts

Insurance In Superannuation Onepath

Can You Pay For Life Insurance Through Your Superannuation

Can You Pay For Life Insurance Through Your Superannuation

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

Life Insurance Premiums Tax Deductible In Super Super Guy

Life Insurance Premiums Tax Deductible In Super Super Guy

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

Superannuation Insurance Premiums Australia Wealth Smart

Superannuation Insurance Premiums Australia Wealth Smart

Life Insurance In Superannuation Improving Outcomes For Members Apra

Life Insurance In Superannuation Improving Outcomes For Members Apra

Post a Comment for "Insurance Premium Superannuation"