Is Income Protection Insurance An Allowable Expense

You can expect to receive about a half to two-thirds of your earnings before tax from your normal job. Employees wages and redundancy payments.

8 Resource Rent Taxes The Taxation Of Petroleum And Minerals Principles Problems And Practice

8 Resource Rent Taxes The Taxation Of Petroleum And Minerals Principles Problems And Practice

Thanks 0 By LyneT.

Is income protection insurance an allowable expense. I think that this is because the payment of income protection insurance is non taxable. 7142016 If you wish to put your Income Protection premiums through your limited company as a trading expense it is usually wise to take out Executive Income Protection rather than a personal plan. 15th Oct 2012 1109.

5242017 Property landlords remain able to deduct allowable expenses incurred in relation to their rental property business from rental income provided it can be demonstrated that these expenses have been incurred wholly and exclusively for the property rental business. 9182020 As traditional sick pay is not available to freelancers and self-employed workers income protection insurance can provide peace of mind in case you are not able to work due to illness or injury. The premiums are generally tax deductible.

862008 The allowable expenses listed in Section 58 2 form a class that would include any incidental costs of taking out a life insurance policy for example a mortgage protection policy. It is worthwhile discussing benefit levels and tax implications with a professional adviser before committing to a policy. The amount of income you are allowed to claim will not replace the exact amount of money you were earning before you had to stop work.

Depending on the terms and conditions your pay-outs will continue until youre able to return to work or the policy ends. Where the fee protection policy entitles the policyholder to claim amongst other risks covered for the cost of accountancy fees incurred in negotiating additional tax liabilities resulting from. You must include any payment you receive under such a policy on your tax return.

Property income allowance alternative to expenses and capital allowances From 6 th April 2017 there is a new property income allowance of 1000 which can be deducted from your rental income provided that the income is not received from a connected party instead of any expenses. 692020 When you hold an income protection policy in your name. 832020 How to pay for Income Protection Most providers will insure you for up to 80 of your gross earnings if the premiums are paid through your limited company.

2182015 On the other hand if you fund an income protection policy personally your contributions will be made out of post-tax income but any funds you subsequently receive as a result of a claim would not be taxable. Such a policy is aimed at covering the full amount left outstanding on a persons mortgage if she dies. Ask your insurance provider if your income protection insurance is deductible can be claimed as an expense.

Key man insurance can be an allowable expense but only if you are not a majority shareholder. Protection policy premiums paid as an allowable deduction in computing rental income for income and corporation tax purposes. 7232020 Income protection insurance is something youll hope youll never need to use but if you suddenly get injured or ill and need financial help to cope with everyday expenses it can be a great source of comfort.

Income protection insurance is also known as permanent health insurance. This treatment only applies to mortgage protection policy premiums. Long-term income protection insurance protects you if your earnings drop because of sickness and injury.

With a personal plan tax is paid on the premiums which are paid from post-tax earnings and as a result a claim will be paid tax-free. Any other expenses cannot be offset against rental income. However if you have a combined policy that is covering you for other benefits such as income protection with life insurance or trauma insurance then only the portion of the premium that is protecting your income is deductible.

Claiming expenses on salaries and benefits. However for business owners who are whilst the premiums cannot be offset against corporation tax the payout instead is tax-free. This is also called loss of earnings insurance.

If the policy provides benefits of an income and capital nature only that part of the premium that relates to the income benefit is deductible. Unless anyone says otherwise this appears to confirm that the cost of a mortgage protection policy is deductible under s58 assuming all other s58 conditions are met. Any employee childcare provision you make.

The business pays for the premiums each month and the policy is written in the name of the key individual. Your own wages salary or other money drawn from the business. Quite interesting because you could potentially claim tax credits also and the IP insurance would not count as income.

Insurance and pension benefits for employees. Income protection insurance You can claim the cost of premiums you pay for insurance against the loss of your income. Income protection is in most cases an add on to the insurance you automatically get in your super It generally provides up to 75 of your income if illness or injury temporarily prevents you from working It usually does not provide a benefit for people who are unemployed casual or working part-time What is income protection insurance.

Short-term policies are sometimes known as accident sickness and unemployment products. If you buy IP with your personal post-tax income you can usually arrange cover for up to 55 of your earnings. You can claim any commission you were charged on your income from interest and dividends except bank fees.

The cost of training employees. Below we explain whether as a business-related policy income protection insurance can be classed as a business expense.

Excel Tax Return Workpapers Preparation Template Tax Payment Irs Tax Forms Irs Taxes

Excel Tax Return Workpapers Preparation Template Tax Payment Irs Tax Forms Irs Taxes

Legal Aspects On The Deductions From Income From Business And Profession Ipleaders

Legal Aspects On The Deductions From Income From Business And Profession Ipleaders

8 Resource Rent Taxes The Taxation Of Petroleum And Minerals Principles Problems And Practice

8 Resource Rent Taxes The Taxation Of Petroleum And Minerals Principles Problems And Practice

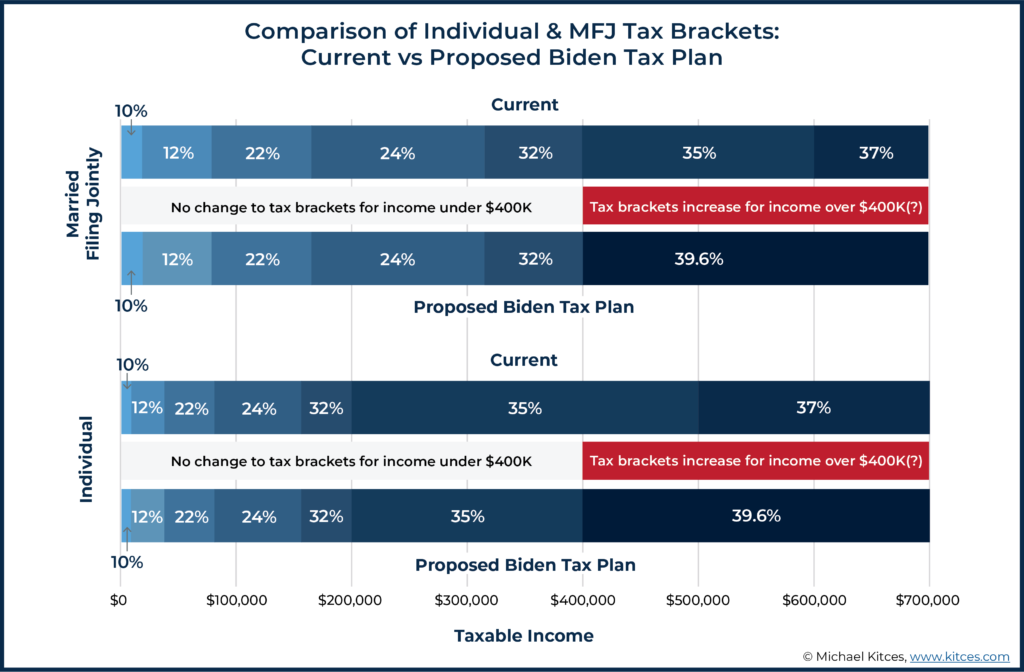

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Tax Plan And 2020 Year End Planning Opportunities

Tax Deductions Business Tax Tax Deductions Direct Sales Business

Tax Deductions Business Tax Tax Deductions Direct Sales Business

![]() Income Protection Personal Ltd Company Icon Accounting Accountancy Services For Contractors

Income Protection Personal Ltd Company Icon Accounting Accountancy Services For Contractors

Account Suspended Real Estate Forms Real Estate Marketing Real Estate Flyers

Account Suspended Real Estate Forms Real Estate Marketing Real Estate Flyers

Kingdom Of Swaziland Kingdom Of Swaziland Selected Issues And Statistical Appendix

Kingdom Of Swaziland Kingdom Of Swaziland Selected Issues And Statistical Appendix

Are Insurance Payments Tax Deductible Infographics Article

Are Insurance Payments Tax Deductible Infographics Article

Protect Your Security Deposit To Protect Yourself And Avoid Any Misunderstandings Make Sure Your Lease Or Ren Being A Landlord Legal Advice Misunderstandings

Protect Your Security Deposit To Protect Yourself And Avoid Any Misunderstandings Make Sure Your Lease Or Ren Being A Landlord Legal Advice Misunderstandings

How To Claim Income Tax Reliefs For Your Insurance Premiums

How To Claim Income Tax Reliefs For Your Insurance Premiums

Which Expenses Are Tax Deductible Novicap

Which Expenses Are Tax Deductible Novicap

The Complete Guide To Income Tax In Sri Lanka Simplebooks

The Complete Guide To Income Tax In Sri Lanka Simplebooks

Further Comments On Business Expenses Low Incomes Tax Reform Group

Further Comments On Business Expenses Low Incomes Tax Reform Group

Are Insurance Payments Tax Deductible Infographics Article

Are Insurance Payments Tax Deductible Infographics Article

Https Www2 Deloitte Com Content Dam Deloitte Bm Documents Tax Barbados Barbados Budget Review 2019 Pdf

Real Estate Income Tax Treatment On Rental Income Summit Planners

Real Estate Income Tax Treatment On Rental Income Summit Planners

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Income Tax Preparation Tax Preparation Tax Prep Checklist

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Income Tax Preparation Tax Preparation Tax Prep Checklist

Post a Comment for "Is Income Protection Insurance An Allowable Expense"